EssilorLuxottica, a global leader in the optical industry, and VF Corporation (NYSE: VFC), a global leader in branded lifestyle apparel, footwear and accessories, announced that they have entered into a definitive agreement for EssilorLuxottica to acquire the Supreme® brand from VF for $1.5 billion in cash.

Francesco Milleri, Chairman and Chief Executive Officer and Paul du Saillant, Deputy Chief Executive Officer at EssilorLuxottica said: “We see an incredible opportunity in bringing an iconic brand like Supreme® into our Company. It perfectly aligns with our innovation and development journey, offering us a direct connection to new audiences, languages and creativity. With its unique brand identity, fully-direct commercial approach and customer experience – a model we will work to preserve – Supreme® will have its own space within our house brand portfolio and complement our licensed portfolio as well. They will be well-positioned to leverage our Group’s expertise, capabilities, and operating platform.”

Bracken Darrell, President and Chief Executive Officer at VF said, “Under VF, Supreme® expanded its presence in the key markets of China and South Korea and has returned to delivering strong growth. However, given the brand’s distinct business model and VF’s integrated model, our strategic portfolio review concluded there are limited synergies between Supreme® and VF, making a sale a natural next step. Alongside the other notable brands in EssilorLuxottica’s portfolio, Supreme® and its talented team will be well-positioned for continued success.” Darrell continued, “While we will always look to adjust the VF portfolio from time to time, this transaction gives us increased balance sheet flexibility. It also supports our overall program to better position the company for long term growth and more normalized debt levels.”

Supreme® Founder James Jebbia commented, “In EssilorLuxottica, we have a unique partner that understands that we are at our best when we stay true to the brand and continue to operate and grow as we have for the past 30 years. This move lets us focus on the brand, our products, and our customers, while setting us up for long-term success.”

The transaction is expected to close by the end of CY2024, subject to customary closing conditions and regulatory approvals. The Supreme® brand runs a digital-first business and 17 stores in the U.S., Asia and Europe. The sale of Supreme® is expected to be dilutive to VF’s earnings per share in fiscal 2025.

J.P. Morgan and Latham and Watkins are serving as exclusive financial and legal advisors to EssilorLuxottica on the transaction, respectively. Goldman Sachs & Co. LLC is serving as lead financial advisor and UBS Investment Bank is serving as financial advisor to VF. Davis Polk & Wardwell LLP is acting as legal advisor to VF.

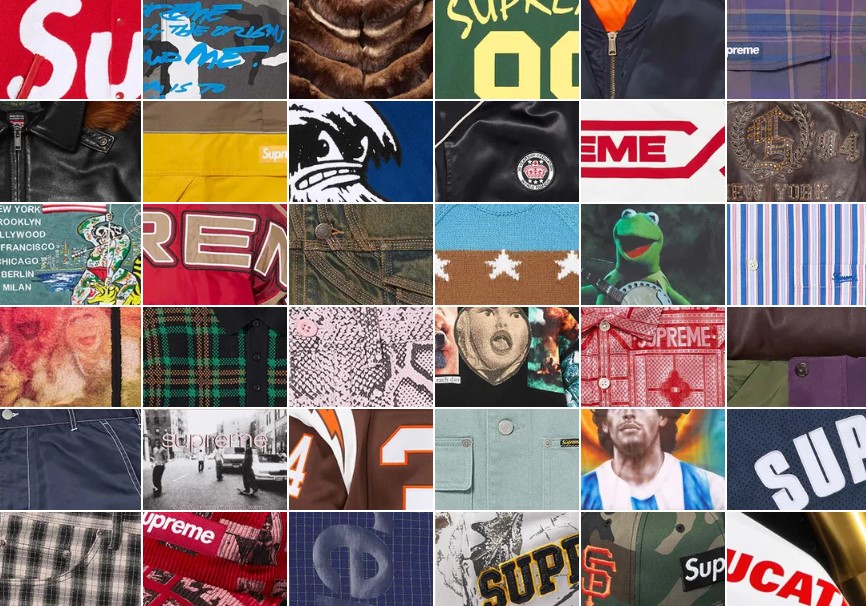

Images courtesy of Supreme